Merge Accounts In Quicken 2015 For Mac

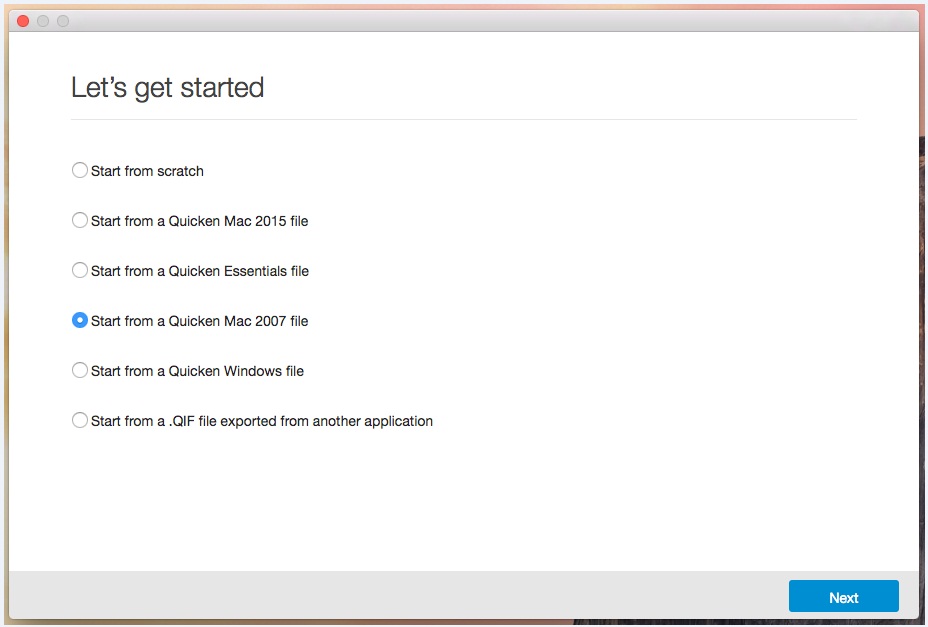

Automatically create a budget based on your past spending. Customize your plan, and track your progress. Easily import data Easily import data from Quicken Essentials for Mac, Quicken Mac 2007, and Quicken 2010 for Windows or newer versions.* Transferring your data can be as simple as 3 easy steps. Easy to get started and keep going Step-by-step guidance helps you get up and running fast.

Phone support, online features, and other services vary and are subject to change. 14,500+ participating financial institutions as of October 1, 2018. • Standard message and data rates may apply for sync, e-mail and text alerts. Visit for details. Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App.

Free antivirus for mac review. This is used for finding all securities with a specific string or characters in it(e.g. Apple will be selected in report but not Microsoft when I type A here.

If you wish to add more accounts, click on Add more accounts. If not, click Finish. Note: In Quicken for Mac, Buy transactions appear as negative transactions and Sell transactions appear as positive transactions.

Laura, thanks for the reply. There is only one physical investment account for my assets so I only get one statement but years ago I made the mistake of representing this single account as 2 accounts in Quicken - one for checking & the other for stocks. I shouldn't have done this but at the time I thought it would be easier to track cash & stocks separately. Now I've come to regret the decision. So, now I've got this Quicken checking account with years of individual checks I've written including interest on the cash and I've got another Quicken account with my stocks and more cash from the dividends. But yes,they are actually the same physical account at my investment company. I'd like to be able to have one Quicken accout which contains my checking, cash, and stocks.

If you want previous statements as well, you can select a different date. Keep in mind, however, that most banks will only allow you to download a period at a time, so you may have to repeat the procedure until you get all the information you need. Open the 'Account Detail' file, and a window should pop up after the download finishes in Quicken versions 2007 or later.

Combine Quicken Accounts

How do I do this? BTW, I'm currently not using any of Quicken's online services due to concerns over privacy regarding my financial data. Can this be done offline? I'd really appreciate any help I can get on this. For good mac huff two part choir. I searched Google but couldn't find a solution. I've got Quicken 2005 Premier H&B and I am trying to figure out how to combine two accounts together.

For planning though, it would be helpful to just have the living expenses increase by an inflation factor each year without decreasing the overall portfolio value. The purchasing power approach can, I think, be easily accomplished by just reducing the expected portfolio return by the projected inflation rate but there does not seem to be an easy way to just apply an inflation factor to expenses.

See for full details and instructions. • Quicken for Mac software and the Quicken App are not designed to function outside the U.S.

Is There A Way To Merge Accounts In Quicken

If you use online banking, you can increase efficiency by having Quicken download your statements and update your accounts each week before you begin. Choose Online: Scheduled Updates; then, in the resulting dialog box, set the day of the week and the time for the automatic update. At that time, Quicken will launch silently in the background, download your financial data, and quit. When you’re ready, you just open Quicken and work with your updated information.

If you do, and if you apply the same logic to your other expenses, you’ll soon have an unmanageable number of categories and subcategories. The smarter thing to do is to create classes in Quicken. Classes are distinct from categories, so they can further define a transaction that has already been assigned to a category. For example, you might create a class for each of your family’s members.